It includes importing and categorizing transactions properly, reconciling these transactions and making sure they’re recorded according to your entry system and accounting method. Before you take on any small-business bookkeeping tasks, you must decide whether a single- or double-entry accounting system is a better fit. The entry system you choose impacts how you manage your finances and how your bookkeeping processes will work. You should also browse the chart of accounts and make sure it’s organized in a way that makes sense for your business. Without bookkeeping, accountants would be unable to successfully provide business owners with the insight they need to make informed financial decisions.

Best Online Bookkeeping Services

The city features many places of worship with golden-domed and cave monasteries, orthodox churches and cathedrals. The most famous ones include the Kiev Pechersk Lavra, one of Ukraine’s most important monasteries and founded in 1077 by St Antoniy. The other is St Sophia’s Cathedral housing the world’s largest collection of frescoes and mosaics from the 11th century onwards. A 15-minute drive from Kiev International Airport, Kiev 365 Hotel features free WiFi and free parking.

EU member states remain divided on controversial CSAM-scanning plan — but for how long?

Now that you’ve got a firm grasp on the basics of bookkeeping, let’s take a deeper dive into how to practice good bookkeeping. There’s no one-size-fits-all answer to efficient bookkeeping, but there are universal standards. The following four bookkeeping practices can help you stay on top of your business finances. If you enjoy organization and numbers and have experience with bookkeeping, https://www.business-accounting.net/accounting-firms-for-startups-top-10-startups/ starting your own business offering this service might be a smart career choice. “It will be unsettling for a time and uncomfortable adjustments will be made. I too, will be making new shopping plans for my books.” The New York Times reported earlier this week that Costco plans to stop regularly selling books year-round starting in January 2025, citing four anonymous publishing executives.

What is Bookkeeping?

Larger businesses adopt more sophisticated software to keep track of their accounting journals. If your company is larger and more complex, you income statement vs balance sheet methods need to set up a double-entry bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account.

- At the end of the accounting period, take the time to make adjustments to your entries.

- According to the US Bureau of Labor Statistics (BLS), the median salary for bookkeepers in the US is $45,860 per year as of 2021 [1].

- The accrual accounting method records financial transactions when they occur rather than when cash exchanges hands.

- Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health.

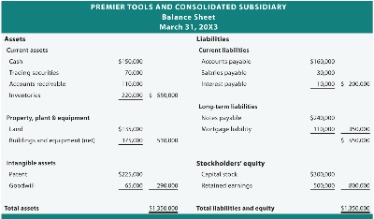

They can’t do that without looking into things like revenue, cash flow, assets and liabilities, which they’ll search for on your balance sheet, income statement and statement of cash flows. Whether it’s updating https://www.simple-accounting.org/ your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year. That way, you can be well prepared when it’s time to file taxes with the IRS.

You can use these to make business decisions, but they should not be presented as audited, certified or official financial statements. Try setting aside and scheduling a ‘bookkeeping day’ once a month to stay on top of your financials. Use that day to enter any missing transactions, reconcile bank statements, review your financial statements from the last month and make any major changes to your accounting or bookkeeping. If you wait until the end of the year to reconcile or get your financial transactions in order, you won’t know if you or your bank made a mistake until you’re buried in paperwork at tax time. Regularly organizing and updating your books can help you catch that erroneous overdraft fee today, rather than six months from now, when it’s too late to bring up. Bookkeeping is the backbone of your accounting and financial systems, and can impact the growth and success of your small business.

You can either keep hard copies or opt for electronic files by scanning paperwork. Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary issues that may need to be addressed. Proper planning and scheduling is key since staying on top of records on a weekly or monthly basis will provide a clear overview of an organization’s financial health. QuickBooks Online is one of the most popular bookkeeping software choices in the US. Its comprehensive reports are easy for first-time business owners to generate and understand, and it offers more thorough reporting than just about any other software out there. While you can do bookkeeping without accounting, you can’t do accounting without bookkeeping.

At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates. From there, the total pay is determined with the applicable taxes and withholdings. In the accounting software, the primary journal entry for total payroll is a debit to the compensation account and credits cash. Your bookkeeper might also prepare other auxiliary reports for your business, like accounts payable and accounts receivable aging reports.

Even with these tools, you may not have the expertise you need to handle the responsibilities of a bookkeeper. Those baby steps can help you manage your organization on a new and improved system. Small steps also give everyone time to familiarize themselves with the new bookkeeping software. If you’re new to business, you may be wondering about the importance of bookkeeping.

Since the IRS accepts digital records, it’s smart to use a cloud-based system like Dropbox, Evernote, or Google Drive so you never have to deal with smudged receipts. You can also use apps like Shoeboxed, which are specifically made for receipt tracking. Outsourcing your bookkeeping is another option, and this guide on how to find the best virtual bookkeeping service can help you get the process started. Christine Aebischer is an assistant assigning editor on the small-business team at NerdWallet who has covered business and personal finance for nearly a decade. Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance.

You’ll get a dedicated accountant, year-round tax advice, tax prep, bookkeeping and financial reports. Both accountants and bookkeepers work to maintain accurate records of finances, and sometimes the terms are used interchangeably. Generally, bookkeepers focus on administrative tasks, such as completing payroll and recording incoming and outgoing finances. Accountants help businesses understand the bigger picture of their financial situation. The two key accounting systems are cash accounting and accrual accounting.

Leave a Reply